Creditas financial results Q3 2020

São Paulo, 18 December 2020.

Today, we announce the results corresponding to the 3rd quarter of 2020.

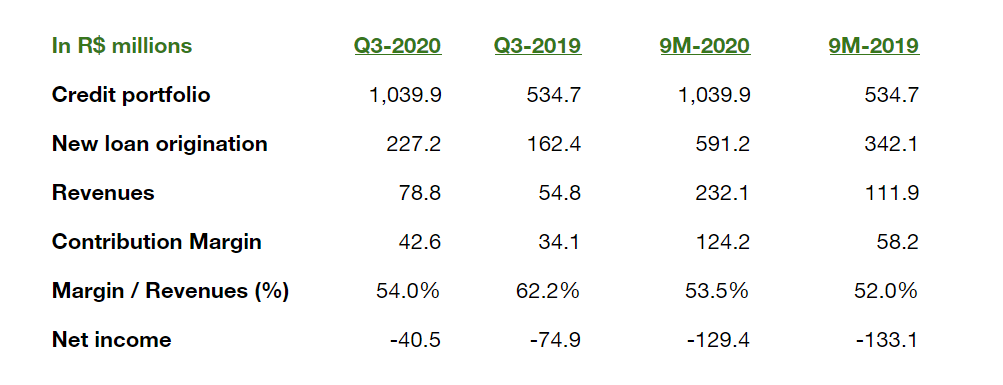

In Q3-20 our credit portfolio passed the R$1bn mark as we started reacceleration of new loan origination. After a conservative period starting in March, by end of July it was evident that our business model was resilient as we confirmed that our credit portfolio had remained with excellent quality and debt capital markets had stayed wide open for us. With that validation, we returned to our pre-covid growth path and finished Q3-20 at similar levels to Q1-20, with September becoming our record month at R$30.4mn in monthly revenues.

Contribution margin (discounting funding costs, servicing costs, credit provisions and taxes) ended the quarter at 54.0% despite increased leverage of the credit portfolio. Net loss fell 46% from Q3-19 despite increase in SG&A as we gain scale through the expansion of our credit portfolio and the related boost in revenues.

In Q3 we completed 2 securitizations for a total of R$325 mn with Debt Capital Markets showing high resilience for Creditas due to the quality of the credit portfolio. For the first time we issued a FIDC (FIDC Auto II) with AAA local rating by S&P. In the quarter we launched our benefits card to create a more complete Creditas @ work ecosystem, now including 5 products: Payroll loan, Salary advance, Creditas Store, Pension funds and Benefits card.

***

Definitions

Credit portfolio.- Outstanding net balance of all our lending products net of write-offs. Our credit portfolio is mostly securitized in ring-fenced vehicles and funded by both institutional and retail investors.

New loan origination.- Volume of new loans granted in the period. If new loans refinance outstanding loans at Creditas, new loan origination includes only the net increase in the customer loan.

Revenues.- Income received from our operating activities including (i) recurrent interest from the credit portfolio, (ii) recurrent servicing fees from the credit portfolio related to our collection activities, (iii) up-front fees charged to our customers at the time of origination, (iv) up-front revenues recognized at the time of the securitization of the loans, and (v) other revenues from both lending and non-lending products.

Contribution Margin.- Margin calculation deducts from our revenues (i) costs of servicing our loan portfolio including headcount, data consumption and third party costs, (ii) costs incurred in our non-lending businesses necessary to generate revenues, (iii) funding costs of our portfolio comprising interests paid to investors and costs related to the issuance of our securitization (eg. auditors, rating agencies, advisors), (iv) credit provisions related to our credit portolio and (v) sales taxes related to fees, interest and other revenues.

Net income.- Net income deducts from our Contribution Margin (i) headcount not included in the credit portfolio servicing cost, (ii) general overhead cost, (iii) customer acquisition cost and (iv) other income and expenses.

Subscribe for

updates

Receive all our news in your email